The passing of recreational cannabis use in the state of California and Nevada, among others, is a huge accomplishment for cannabis advocates in both states!

But, what does this mean for the medical marijuana industry, and current medical cannabis patients?

Do I Still Need a Medical Cannabis Card in California?

In short, yes!

The passing of Prop 64 in California allows adults 21 and over to use marijuana recreationally, in the privacy of their residence, or in a business licensed for recreational consumption.

Californians can now have up to 28.5 grams of marijuana and 8 grams of concentrated marijuana (wax, oils, etc.). You can also grow up to 6 plants in your home, as long as they are behind a locked door and out of public view (so not near any windows!).

Here’s the catch- Businesses must receive special recreational licensing in order to start legally selling cannabis as a recreational product, and the state will not even begin allowing licensing until January 1st, 2018.

SO, if you do not have a medical cannabis card, and you are given an ounce of marijuana, great! You can legally smoke it! But if your friends aren’t that generous, you will still need a medical cannabis card in order to purchase your cannabis products– at least until 2018.

Do I Still Need a Medical Cannabis Card in Nevada?

Do I Still Need a Medical Cannabis Card in Nevada?

Again, yes!

Similar to California, the passing of Question 2 allows for adults 21 years and older to use marijuana recreationally, in the privacy of their home, or another recreationally licensed facility.

Nevada residents and visitors can have up to one ounce of marijuana and one-eighth of an ounce of concentrated marijuana. You can also grow up to 6 plants, as long as they are behind a locked door and out of public view.

So, when can you smoke in Nevada? Leaders in the Nevada cannabis industry are projecting that it will take anywhere from 6-8 months for officials to iron out the details of recreational cannabis policy. After that, limited licenses will only be handed out to current medical dispensaries. The number of recreational licenses available to each county will be determined by the county population.

That being said, like California, you may have to wait until 2018 before you can purchase cannabis for recreational use.

This means that, yes, you still need your medical cannabis card to purchase cannabis in Nevada! (Again, unless you have a friend willing to give you their cannabis- introduce me to this friend!).

Will Cannabis Now Be Heavily Taxed?

Will Cannabis Now Be Heavily Taxed?

Yes and no.

California

As of January 1st, 2018, cannabis sales will have 2 new excise taxes. The first is a cultivation tax of $9.25 per ounce for flowers and $2.75 per ounce for leaves. There will also be a 15% retail tax placed on cannabis sales.

However, as of November 9th, 2016, medical marijuana cardholders who register as a patient with the state of California (this is an additional step that you can take after getting your medical marijuana card, but you do not have to take) will be exempt from paying sales taxes on medical cannabis.

So, using your medical card could potentially save you a few bucks in the future– just remember to keep your receipts to use during tax season!

For more information on new taxing, you can go here: Cannabis Taxing Policy

You can register as an official medical marijuana patient by going in person to your county’s local office. You can find yours, here: County Offices

Nevada

Much like California, there will be a 15% tax placed on all cannabis sales. This is in addition to any state and local county taxes that may also be put into place in the coming year.

In Nevada, it is already required to register with the state in order to receive your NV State medical cannabis card. For more information on whether medical marijuana patients will be exempt from certain taxes, you can locate & contact your local office here: NV State Offices

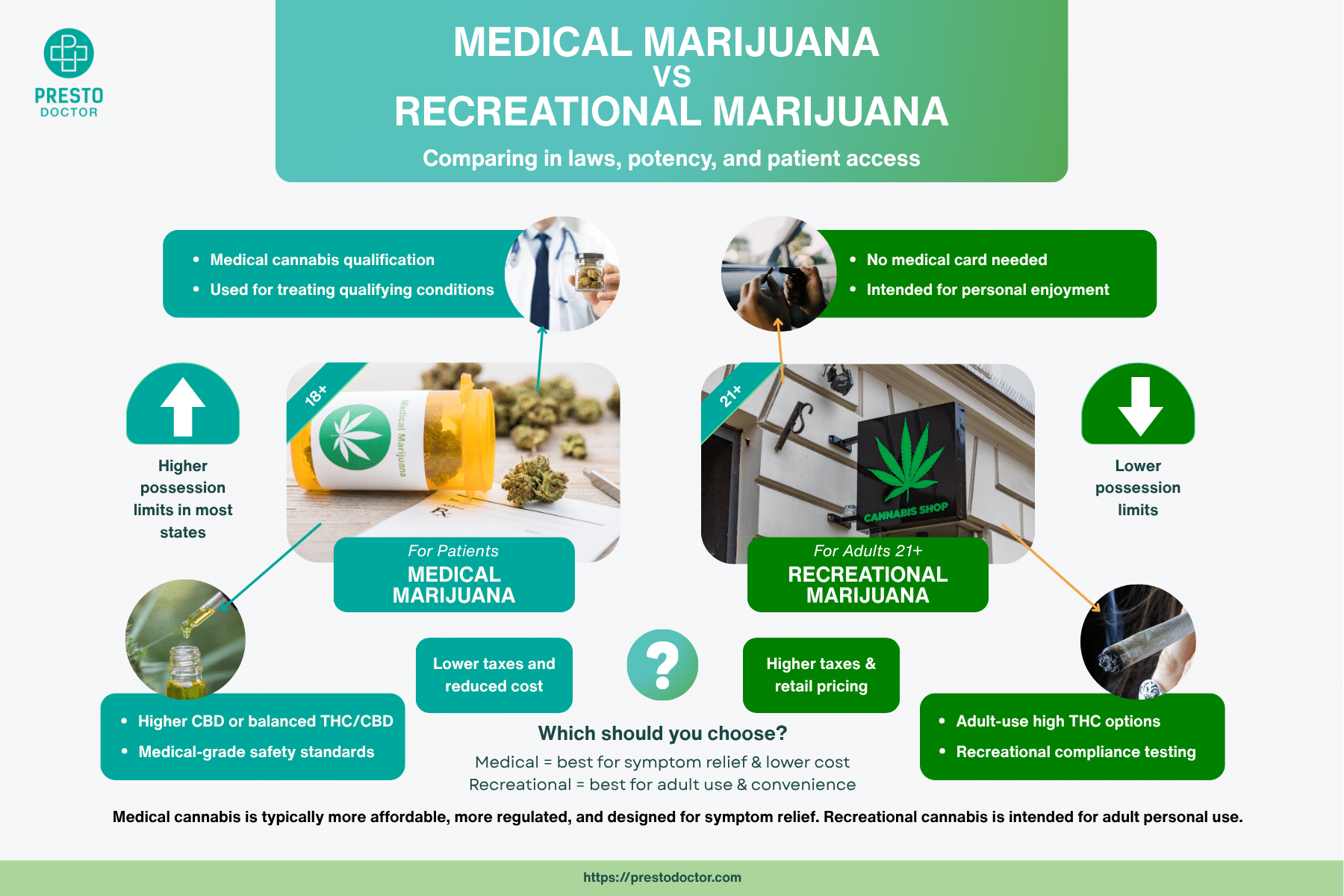

Benefits of Having a Medical Cannabis Card

Benefits of Having a Medical Cannabis Card

- Recreational sales will not start in California and Nevada until 2018, so if you want to purchase cannabis products, using your medical card is the only way!

- You may be exempt from some taxation requirements if you use your medical card to buy marijuana products– Who doesn’t like a tax break?

- Your doctor can offer you a customized medical treatment plan to help you understand which strains of cannabis work best for you + which method of consumption will work best for your lifestyle. Conscious, educated consumption is never a bad thing!

Do I Still Need a Medical Cannabis Card in Nevada?

Do I Still Need a Medical Cannabis Card in Nevada? Will Cannabis Now Be Heavily Taxed?

Will Cannabis Now Be Heavily Taxed? Benefits of Having a Medical Cannabis Card

Benefits of Having a Medical Cannabis Card