Introduction

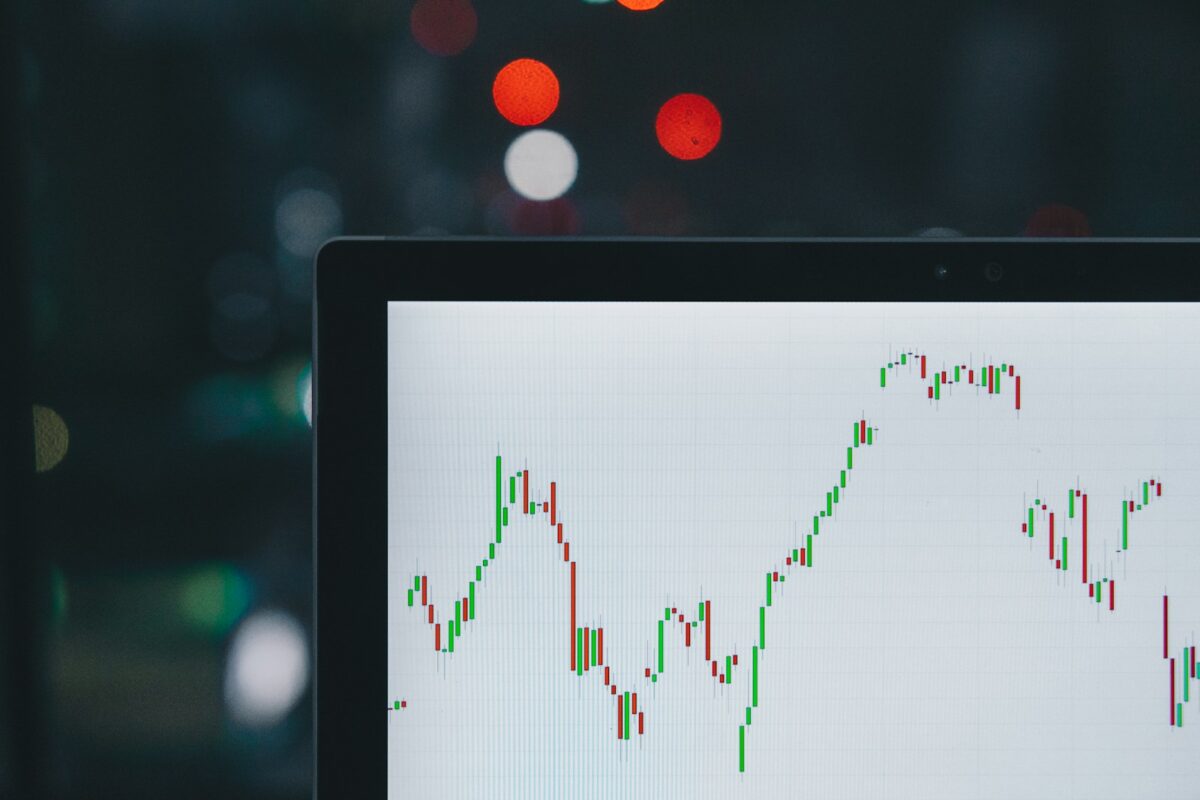

The cannabis stock market continues to be a highly volatile sector, affected by rapid changes in regulatory policy, political shifts, and evolving public perception. While marijuana legalization efforts have gained traction globally, cannabis stocks remain sensitive to local legislation and federal reform delays. In 2024, the financial performance and valuations of these stocks reflect the complex interplay between optimism for decriminalization and ongoing legal challenges. This article explores the factors driving cannabis stock volatility and evaluates investment strategies in light of recent market shifts. With recent market shifts leaving cannabis MSO stocks down more than 85%, many people are wondering what will happen in the future in the cannabis industry. Following the recent election and potential impending cannabis legalization, it could have an effect on your cannabis stocks.

Why Are Cannabis Stocks Volatile?

Cannabis stocks have been known for their significant price fluctuations, driven primarily by legal uncertainties, market speculation, and fluctuating consumer demand. Unlike traditional industries, cannabis companies face regulatory scrutiny at both state and federal levels. These hurdles, combined with high operating costs and limited financial support from banks, make cannabis stocks more prone to volatility. Recent developments, such as changes in political support and legislative votes on adult-use legalization, further contribute to their unpredictable market behavior.

Current Market Conditions: A Post-Election Day Slump

Following the 2024 U.S. elections, cannabis stocks saw a considerable downturn. Major multi-state operators (MSOs) like Ayr Wellness, Curaleaf, and Trulieve experienced sharp declines. Sharp declines such as the American Cannabis Operator Index dropping nearly 27%. This decline has been attributed to setbacks in adult-use legalization votes across states like Florida, North Dakota, and South Dakota. The results dampened investor sentiment, as these regions were seen as potential high-growth markets for the industry. This election outcome highlighted the challenge cannabis companies face in achieving state-level approval and the significant market impact of such policy decisions. The outcome continues to prove how much cannabis legalization affects cannabis stocks.

Florida’s Failed Adult-Use Legalization: Immediate Impacts

Florida’s rejection of adult-use cannabis legalization in November 2024 delivered a significant blow to cannabis stocks. Companies heavily invested in the state, particularly Trulieve, which financed much of the pro-legalization campaign, saw their stock values drop sharply. Trulieve and Curaleaf, two of the largest cannabis MSOs, recently gave another $6 million to Florida’s adult-use legal campaign in 2024. However, Amendment 3 was still rejected in Florida despite their efforts. Now that Florida legalization is off the table, for now, cannabis MSOs may face challenges.

This loss underscores the difficulty cannabis MSO companies face in advancing legalization in conservative regions, where public support remains divided. Despite optimism in other states, the failure in Florida signals that substantial political obstacles remain. This is true even in states where medical marijuana use is already legal.

MSOs (Multi-State Operators) and the Challenges They Face

U.S.-based cannabis multi-state operators (MSOs), including Verano, Cresco Labs, and Curaleaf, are grappling with complex regulatory and financial challenges. These companies operate across multiple states, each with its own cannabis laws and compliance requirements. This patchwork of regulations increases operating costs, limits efficiencies, and impacts profit margins. Additionally, MSOs are unable to access traditional banking services due to federal restrictions, making it difficult to manage finances effectively and seek financing for expansion.

Why Cannabis Stocks Are Down: The Regulatory Picture

Regulatory uncertainty remains a central issue for cannabis stocks. The lack of federal legalization in the U.S. places the cannabis industry in a difficult position. It is responsible for restricting its growth potential and increasing investment risks. The current regulatory framework is further complicated by agencies like the Drug Enforcement Administration (DEA) and the Food and Drug Administration (FDA). These agencies regulate cannabis-related products inconsistently across different states. The federal prohibition on cannabis banking adds another layer of complexity. Consequently, it affects the valuations and financial health of publicly traded cannabis companies.

Positive Movement: Trump’s Support for Marijuana Reform

Recent political developments have sparked hope for cannabis investors. Former President Donald Trump’s reported support for marijuana reform, particularly his potential backing of federal deregulation, has led to temporary boosts in stock prices. Trump’s pro-business stance, if followed by actual legislative changes, could open new opportunities for cannabis companies, particularly MSOs. Such a move could lower tax burdens, ease banking restrictions, and enable wider acceptance of cannabis products at a national level.

Recent Gains: Trump’s Proposed Deregulation Agenda and MSO Spikes

Speculation over Trump’s influence on potential marijuana deregulation has already led to notable gains in cannabis stock prices. MSOs such as Green Thumb, Verano, and Cresco Labs saw their stocks rise by over 15% following news of this support. Cronos, a Toronto-based cannabis firm, also saw its stocks surge after outperforming Q3 revenue expectations. Although the outlook remains uncertain, Trump’s proposed deregulatory agenda could significantly impact the industry’s long-term financial health. This is particularly true for major players within the MSO category.

Why Cannabis Stocks Are Rising: Corporate Earnings Boost

Positive earnings reports have also contributed to the recent uptick in cannabis stocks. Companies like Cronos Group have reported higher-than-expected quarterly earnings, which has driven stock price gains. In Q3 2024, Cronos reported earnings of $0.02 per share on revenue of $34.26 million. This was a 38% increase from the previous year. These earnings exceeded Wall Street estimates, providing a much-needed boost to Cronos’ stock price amidst a turbulent market. Such financial gains highlight the resilience of companies that can adapt to economic pressures and regulatory challenges in the industry.

Why Is Cannabis Stock Dropping: Economic and Operational Pressures

Despite positive earnings, cannabis stocks continue to face downward pressure due to economic and operational challenges. High tax rates on cannabis products, limited banking options, and competition from unregulated markets impact profit margins and drive up operational costs. This financial strain discourages some investors, who may see traditional investments as a safer option. Until these economic issues are resolved, cannabis stocks are likely to experience continued volatility.

Valuation Concerns in the Cannabis Industry

Cannabis stocks have often been viewed as overvalued, given the high levels of speculation and limited federal support. The industry’s growth potential is substantial, but current valuations may not accurately reflect the regulatory and financial hurdles faced by cannabis companies. Experts caution that without meaningful policy reform and a clear pathway to federal legalization, cannabis stock valuations are likely to remain vulnerable. This valuation issue has made institutional investors wary of diving into the sector, reducing the potential for new capital inflows.

Impact of Global Competition on U.S. Cannabis Stocks

International cannabis companies, particularly those based in Canada and Europe, have increasingly impacted the U.S. cannabis stock market. Firms like Cronos and Canopy Growth, which operate under less restrictive regulatory environments, are able to achieve scale and attract international investment more easily than U.S.-based companies. This competition has put pressure on U.S. MSOs to innovate and compete on both quality and price, despite their higher operational costs due to federal restrictions.

Investment Strategies Amidst Uncertainty

Cannabis stock investors are adopting various strategies to manage the risks associated with cannabis stocks. Many investors are focusing on companies with strong fundamentals, such as positive cash flows and manageable debt levels. Some are diversifying their portfolios with exposure to both U.S. and international cannabis stocks. Meanwhile others are waiting for legislative changes before investing heavily. Additionally, a trend toward supporting companies involved in cannabis research and development is emerging. These companies are seen as less vulnerable to regulatory challenges than traditional dispensaries or retail operators.

Cannabis stock investors are advised to look at cannabis company fundamentals before choosing a cannabis stock. Some key performance indicators for cannabis companies, including cannabis MSOs, are the number of dispensaries, dispensary growth rate, size and number of cultivation facilities, as well as the average revenue per dispensary and price per pound of cannabis. Additionally, cannabis stock investors should look for positive cash flow companies.

Is the Future Bright for Cannabis Stocks?

While the future of cannabis stocks remains uncertain, recent political shifts provide cautious optimism. Legislative momentum is building for cannabis reform, with ongoing efforts to introduce bills that address banking access, tax reform, and even federal decriminalization. If these measures are successful, they could create a more stable environment for cannabis stocks and an increase in happy cannabis investors. However, given the continued opposition in certain states and regulatory bodies, the industry is likely to face significant obstacles before achieving widespread acceptance and stability.

Conclusion

The cannabis stock market in 2024 reflects a dynamic and challenging landscape marked by political, regulatory, and economic uncertainties. While there are promising developments, such as potential deregulation support from political figures like Trump, setbacks in state-level legalization efforts continue to weigh heavily on stock performance. For cannabis stock investors, the key lies in understanding these risks and adapting investment strategies to align with the evolving cannabis industry. As the sector matures and regulations potentially ease, cannabis stocks could offer substantial growth opportunities for those willing to navigate its unique challenges.

Editorial Disclaimer: The views and opinions expressed in this content belong solely to the author & do not represent those of any bank, credit card company, airline, hotel chain, or other business. These entities have not reviewed approved, or endorsed the content in any way. This content is for educational purposes only and should not be considered financial investment, insurance, or legal advice. Everyone is advised to consult a qualified financial professional before making any financial insurance, or investment decisions.