Why Michigan’s New Marijuana Tax Is Sparking Outrage

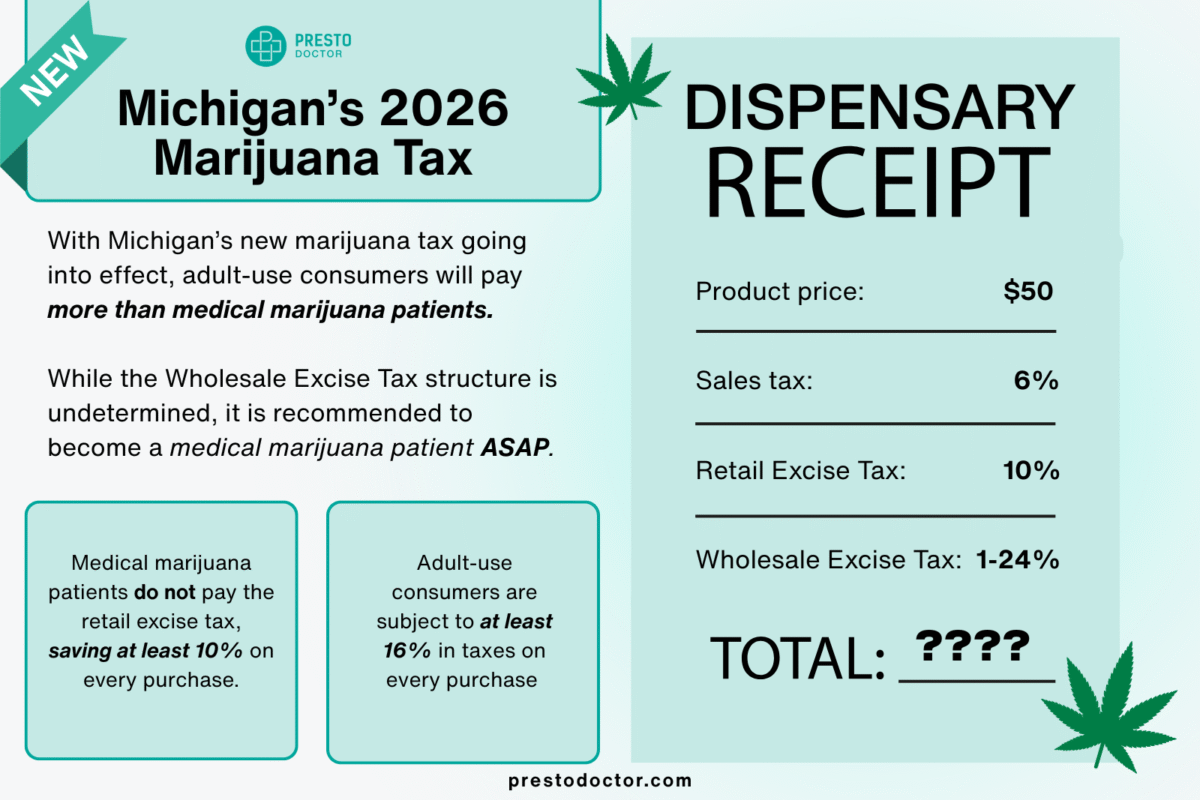

If you live in Michigan and enjoy cannabis, you’ve probably heard about the new Michigan marijuana tax making headlines. Michigan’s new 24% wholesale cannabis tax—imposed on growers and processors but passed down through retail prices—may cause the cost of recreational marijuana to soar leaving a huge price impact on consumers. Getting a medical marijuana card may be a way to save money on Michigan’s new taxes. With this new 24% wholesale marijuana tax, a lawsuit from the Cannabis Industry Association has sparked.

Consumers may now be paying nearly 24–26% more at dispensaries, while medical patients remain exempt from these new taxes.

So, what does this mean for you? In this article, we’ll break down the new Michigan cannabis tax rate, how it affects dispensaries and customers, and—most importantly—how getting your medical marijuana card can save you hundreds every year.

What Is the Michigan Marijuana Tax?

In October 2025, Michigan lawmakers passed a 24% wholesale marijuana tax, officially called the Michigan Cannabis Tax Act (HB 5876). The law adds a wholesale excise tax on all cannabis products sold by growers and processors to retailers.

Even businesses that hold both medical and recreational licenses aren’t exempt. According to the Michigan Department of Treasury, any transfer of cannabis from a medical provisioning center to its adult-use retail operation counts as a taxable wholesale transaction — even if done daily or simultaneously with a sale. These transfers must also be logged in the METRC tracking system, ensuring every move is taxed at the 24% wholesale rate.

Note: While the new 24% cannabis tax is applied at the wholesale level to growers and processors, most dispensaries pass this cost on to consumers through higher retail prices. That means recreational shoppers ultimately pay the difference—while medical marijuana patients remain exempt from those markups. This will likely impact consumers when the wholesale tax expenses are passed down from retailers in the form of price increases on products.

Key Tax Components:

| Tax Type | Rate | Applies To |

|---|---|---|

| Wholesale Cannabis Tax | 24% | Producers & Processors |

| Recreational Excise Tax | 10% | Retail Sales |

| Sales Tax | 6% | Retail Sales |

| Total Recreational Tax Burden | ≈ 40% | Final Consumer |

Medical marijuana patients, however, only pay the 6% sales tax—no excise or wholesale tax.

That’s where your medical marijuana card becomes your ticket to saving money.

Why Did Michigan Add a 24% Cannabis Tax?

According to Michigan lawmakers, the goal is to use marijuana tax revenue to fund state infrastructure, specifically fixing roads. You may have heard it branded as the “Pot for Potholes” initiative.

Where the Money Goes:

- 70% → Michigan Road Improvement Fund

- 20% → State Cannabis Regulatory Oversight

- 10% → Local Governments

However, this move sparked backlash from cannabis advocates and dispensary owners who argue it could cripple small businesses and drive up prices for consumers.

Michigan Marijuana Tax Lawsuit: Industry Pushback

Almost immediately after the tax passed, the Michigan Cannabis Industry Association filed a lawsuit challenging its constitutionality. The Michigan Cannabis Industry Association filed a lawsuit with claims that the Michigan marijuana tax is unconstitutional because it altered a voter-approved law without a three-fourths legislative supermajority.

Their argument? The 24% cannabis tax unfairly targets licensed operators while undermining Michigan’s legal cannabis market in favor of the black market and out-of-state competition.

Dispensary owners have warned that they may be forced to raise prices or cut staff, with many calling the policy “unsustainable.”

“This new tax could devastate Michigan’s cannabis industry,” said one dispensary owner in a WZZM13 report. “Customers are already feeling the pinch.”

How Much More Are You Paying at the Register

Let’s break it down in simple terms.

If you buy a $200 ounce of flower, here’s the difference between recreational vs. medical:

| Type | Base Price | Taxes | Final Cost |

|---|---|---|---|

| Recreational | $200 | $56 (~24% price increase from wholesale tax pass-through + 10% excise + 6% sales) | $256 |

| Medical | $200 | $12 (sales tax only) | $212 |

That’s a $44 savings per ounce, or about 17%.

Michigan Marijuana Price Impact Calculator 💰

Estimate how Michigan’s new cannabis tax affects retail prices—and how much you could save with a medical card.

Example Savings:

| Product | Base Price | Total Recreational | Total Medical | Savings | % Saved |

|---|---|---|---|---|---|

| ⅛ oz Flower | $35 | $44.80 | $37.10 | $7.70 | 17.2% |

| Vape Cart (1g) | $40 | $51.20 | $42.40 | $8.80 | 17.2% |

| 1 oz Flower | $200 | $256.00 | $212.00 | $44.00 | 17.2% |

Average Michigan cannabis consumer spending $150/month saves nearly $400 per year by switching to medical.

Michigan Marijuana Tax Savings Calculator

*This model assumes dispensaries pass through wholesale tax costs to customers through higher retail prices, though the tax itself is imposed only on licensed growers and processors.

Michigan Dispensary Reactions: “It’s Hurting the Industry”

Dispensary owners are reporting that customers are buying less, and some are considering cutting hours or downsizing.

- “We already pay high compliance fees,” one shop owner told MLive.

- “This new tax could push people back to unlicensed sellers.”

Meanwhile, medical dispensaries are seeing an uptick in patient visits, as people realize how much money they can save.

Michigan Cannabis Tax Revenue: Who Really Benefits?

Michigan expects to collect over $420 million per year in cannabis tax revenue. While that may sound promising for infrastructure, critics point out that these funds rarely make it back to local communities where the money is generated.

For example:

- Only a fraction goes to local road maintenance

- Most is absorbed into state-level funds and administrative costs

- Patients and small dispensaries bear the brunt of the policy

How to Avoid the Michigan Marijuana Tax: Get a Medical Card

The easiest way to avoid paying the extra 24% wholesale cannabis tax and the 10% recreational excise tax is to get your Michigan medical marijuana card. Getting a medical marijuana card in Michigan ensures you save money on taxes.

Benefits of a Michigan MMJ Card:

✅ Save up to 17–25% on every purchase

✅ Access higher THC limits and exclusive medical strains

✅ Skip recreational shortages and limits

✅ Get tax-free cannabis from licensed medical dispensaries

You can get your card online with PrestoDoctor in just minutes.

Get your medical marijuana card in Michigan today.

Conclusion: Don’t Pay the Price of the New Tax

Michigan’s marijuana tax overhaul is reshaping and impacting the state’s cannabis market —and not in favor of consumers. Between the 24% wholesale cannabis tax, 10% excise tax, and 6% sales tax, recreational users may be losing hundreds of dollars annually.

The Michigan Department of Treasury has published guidance on the new wholesale tax, stating it will move forward with implementation on January 1, 2026, unless the marijuana tax lawsuit succeeds in obtaining an injunction.

But medical marijuana patients?

They’re avoiding nearly all of it.

If you want to keep more money in your pocket while still getting quality cannabis legally, getting your Michigan medical marijuana card is the smartest move you can make.

Get certified today with PrestoDoctor and see how much you can save.

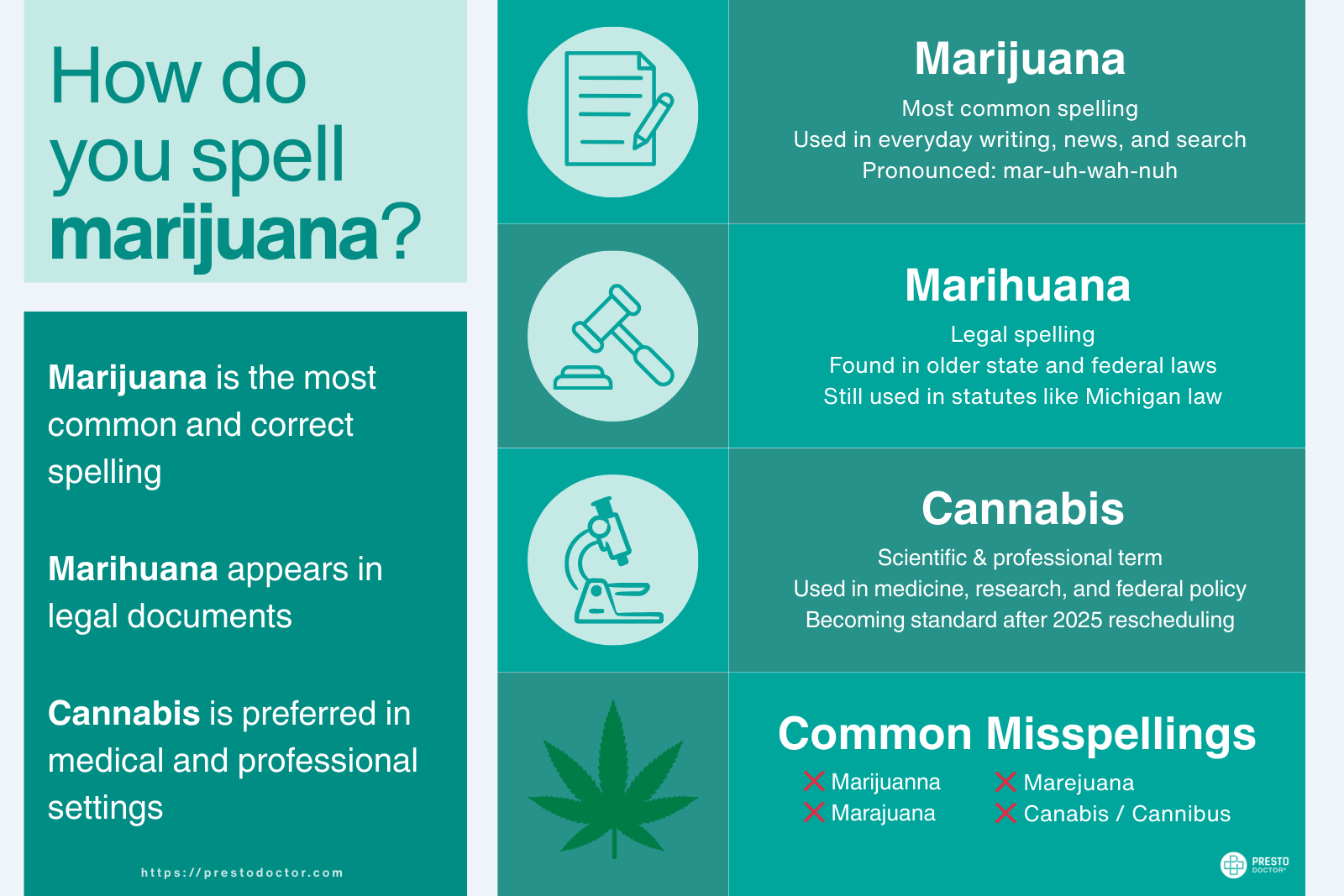

For more information, visit Michigan’s Wholesale Marihuana Tax FAQ